Honest credit card limit

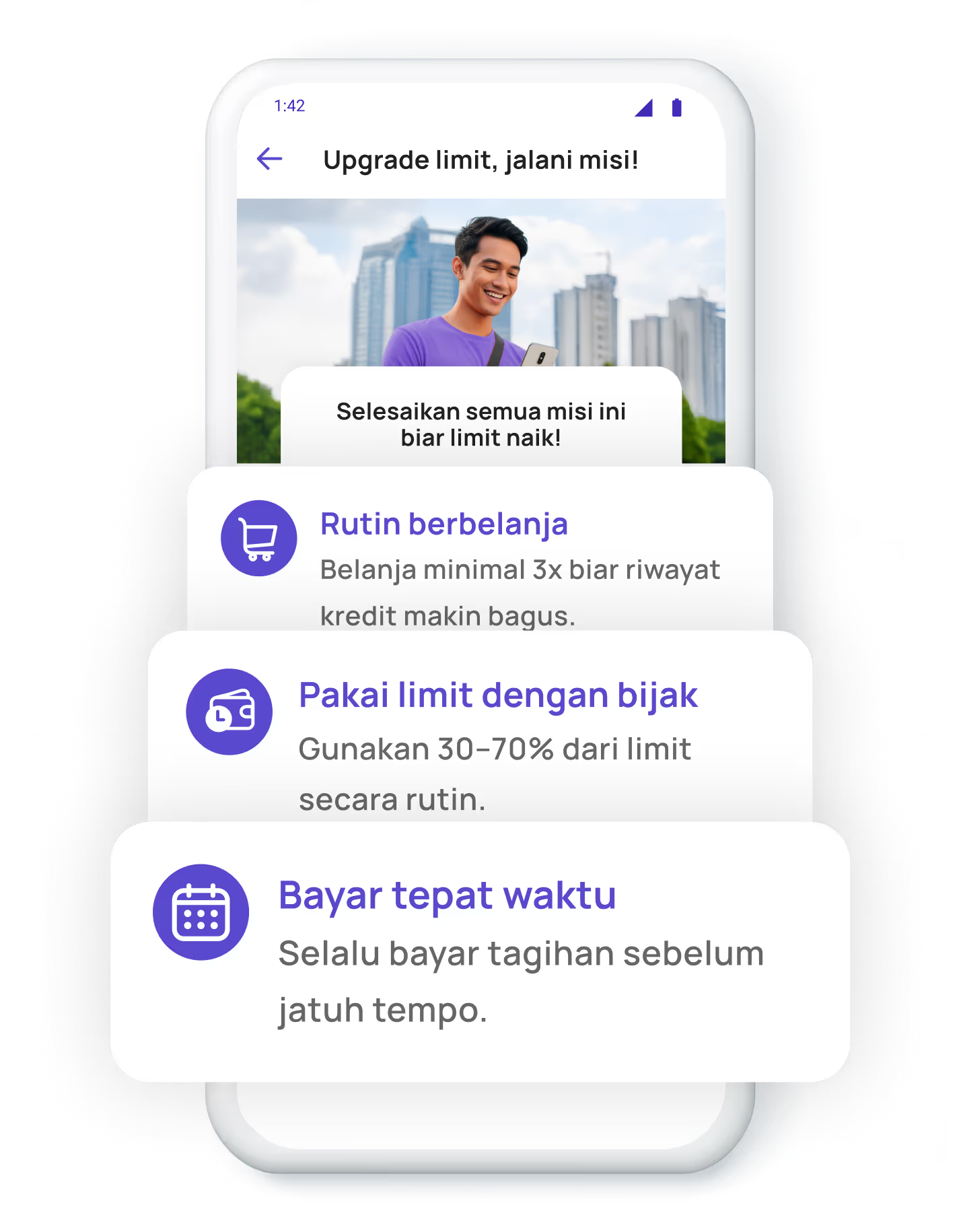

Simple missions can double your limit

Benefits of Honest’s fee refund program

Limit that fits

Starts from Rp1 can grow monthly up to Rp100 million

Auto-reviewed every month

Credit limit is evaluated based on monthly usage.

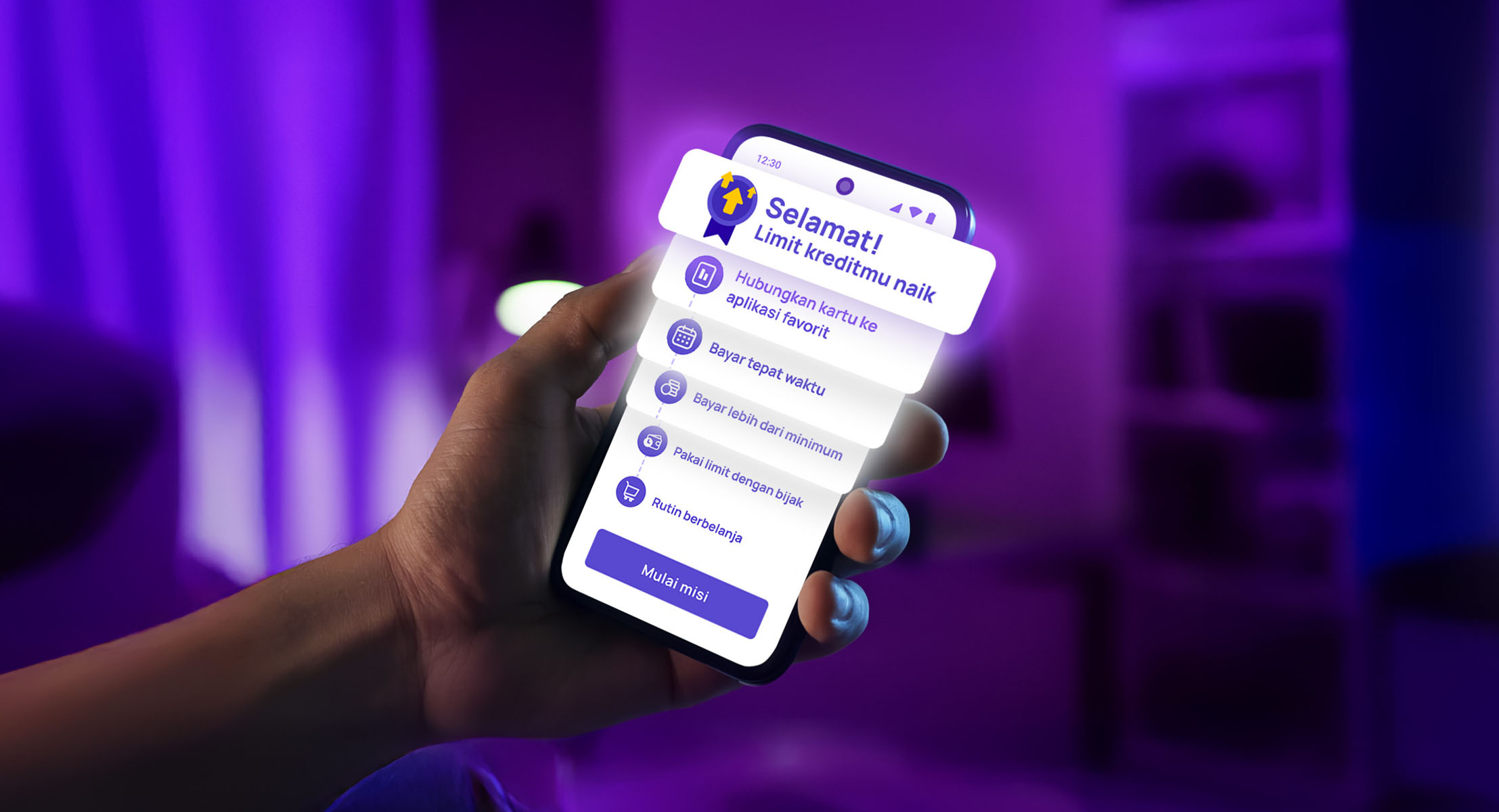

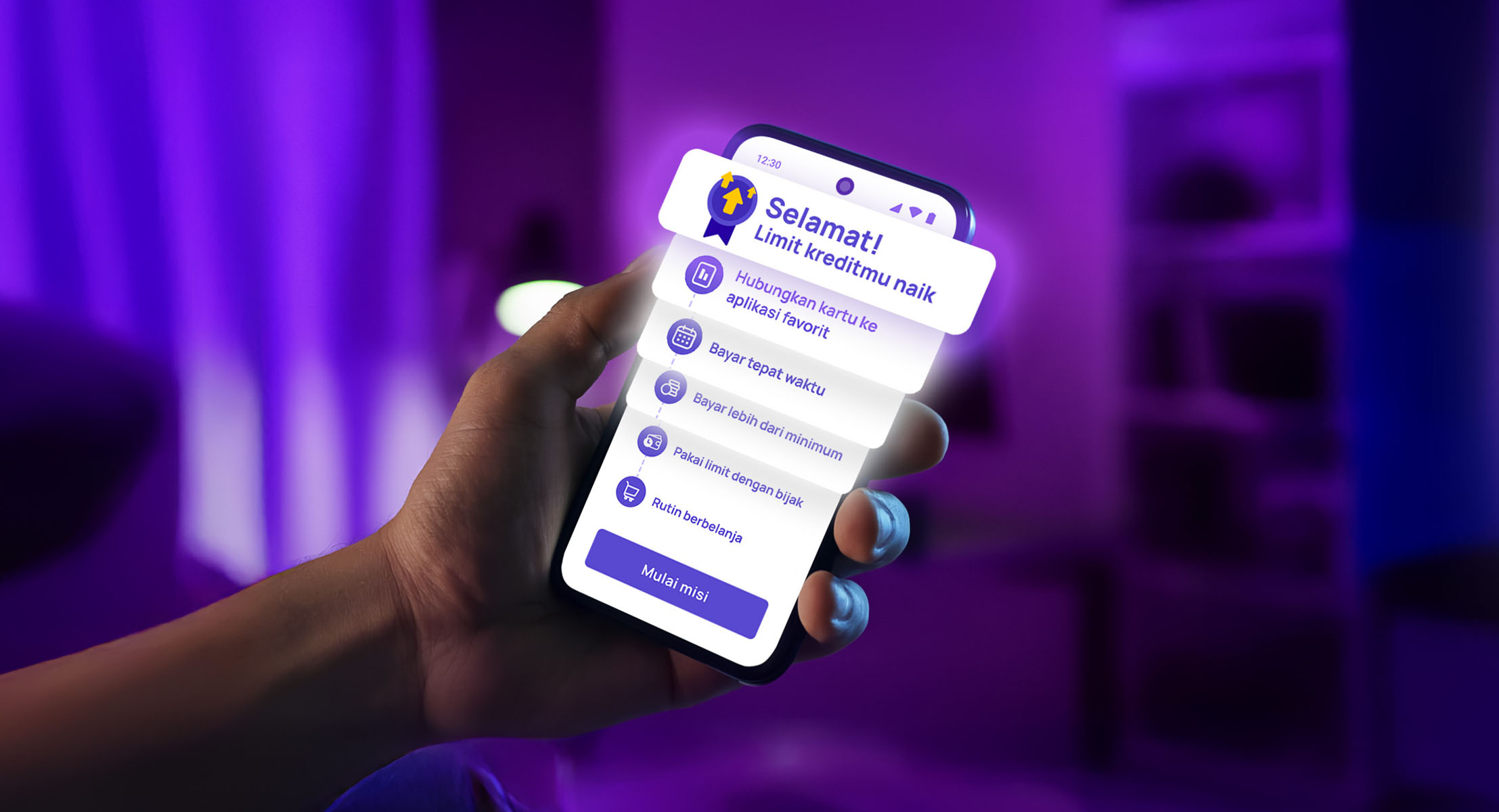

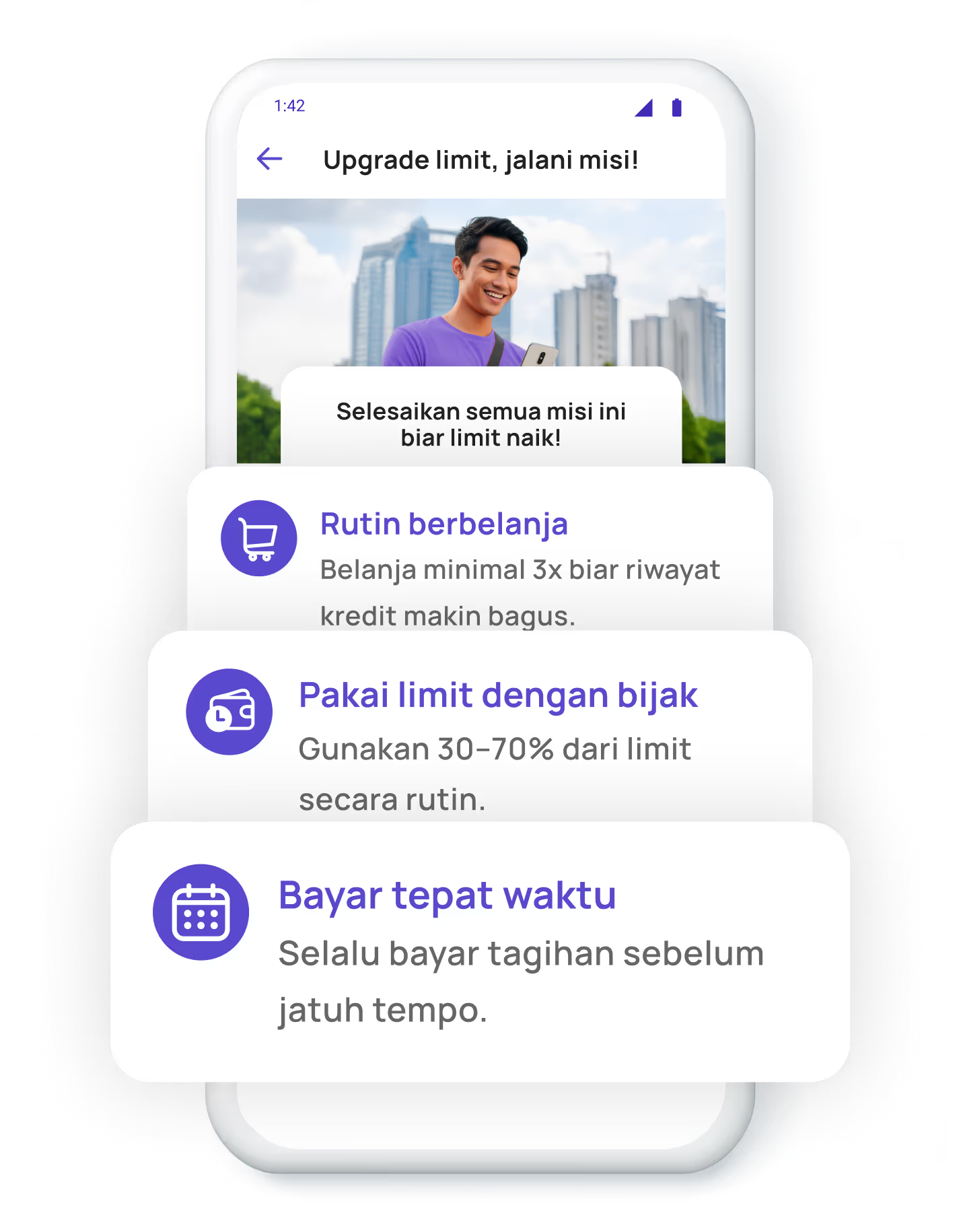

Simple in-app missions

Complete easy tasks before your evaluation date to grow your limit.

How Honest calculates & increases credit limit

Get an initial limit based on your financial profile.

Use the card regularly to show healthy spending patterns.

Complete in-app missions, like timely bill payments and daily purchases.

We’ll auto-review your credit limit each month

If you qualify, your limit increases.

Why growing your limit with Honest matters?

Safer for first-timers to build healthy credit habits

Chances for limit increases with consistent use

Avoid manual limit requests

Helps improve credit score & BI checking

Why growing your limit with Honest matters?

Safer for first-timers to build healthy credit habits

Chances for limit increases with consistent use

Avoid manual limit requests

Helps improve credit score & BI checking

Tips for managing your Honest Credit Card limit wisely

Use your credit limit wisely

A bigger limit doesn’t mean you have to spend it all.

Avoid maxing out your limit

Keep your spending below 80% of your total Honest Credit Card limit.

Review your usage regularly

Check your remaining credit limit and transaction history weekly.

FAQ about Honest Credit Card limit

What is a credit card limit?

Definition of a credit card limit

A credit card limit is the maximum amount you can spend using your card. At Honest, your credit limit is set to match your financial profile. Not too high, but safe and suitable for daily use.

Benefits of a credit card limit

Besides being a spending cap, your credit limit helps you control your expenses! With Honest, you can track your usage and remaining credit limit in real-time through the app.

What factors affect the amount of your credit card limit?

Credit history and credit score

The better your payment history, the higher your chances of getting a larger credit limit.

Debt-to-income ratio

Banks and card issuers will check how much debt you have compared to your monthly income. This affects how your credit limit is determined.

Number of credit cards owned

Having too many credit cards may reduce the limit offered by Honest. We’ll adjust it wisely based on your total credit exposure.

How does a credit card limit work?

Using your limit

Every time you make a transaction, the amount is deducted from your available credit. That’s why it’s important to check your remaining limit before spending.

Repayment and credit restoration

Once you pay your bill, your credit limit will be restored by the amount you’ve paid. This is the basic principle of how credit limits work.

Overlimit and consequences

If your transaction exceeds the limit, it can be declined or trigger extra fees. Honest helps prevent this with real-time notifications.

How does Honest calculate and adjust your credit limit?

Honest calculates your credit limit based on your income, credit history, and other financial data. We also use a transparent self-evaluation system so you can estimate your potential credit limit before applying.

Curious about how to get a higher limit? Learn how to increase your Honest credit limit.